Mining Bitcoin (or any SHA-256 coin) with an ASIC is a capital decision: you’re buying hardware that will lose value as new generations arrive, and your profitability depends on electricity costs, network difficulty and the machine’s efficiency. Below is a clear, realistic breakdown of when to buy new and when a used miner makes sense — plus a checklist to avoid scams and boost your chance of a positive ROI.

Quick verdict

Buy new if you prioritize long-term efficiency, warranty support, and minimal downtime.

Buy used if you want lower upfront costs, faster payback and you can accept higher maintenance risk — especially if you have access to cheap electricity.

Why efficiency and warranty matter

New ASIC models deliver better joules-per-terahash (J/TH) — meaning they do more hashing for every watt you feed them. That efficiency translates directly into lower energy bills per unit of mining revenue and often makes new units the better long-term bet in regions where electricity isn’t dirt cheap. New machines also usually come with 6–12 month manufacturer warranties and official firmware/support channels, which reduce the risk of being left with an expensive paperweight.

What you get with used miners

Used miners trade lower purchase price for potentially higher running costs and shorter remaining lifespan. The pro: you can often buy older models for a fraction of the new list price and start mining immediately — a fast ROI if electricity is inexpensive and the device is healthy. The con: degraded chips, worn fans, burnt PSU components or hidden overheating damage can quickly erase any up-front savings.

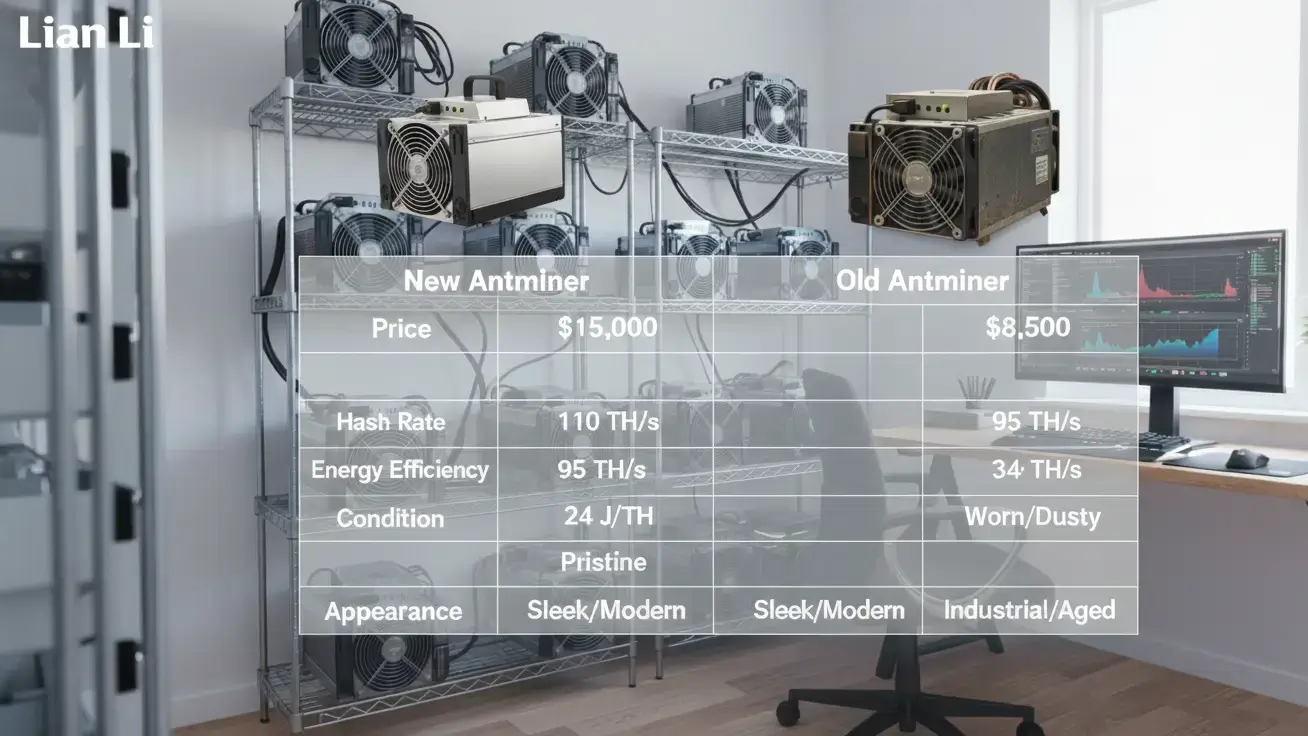

Energy efficiency — a concrete example

To make a sensible comparison, look at efficiency numbers. Recent examples show modern machines can operate in the teens of J/TH while older units sit much higher: for example an Antminer S21 (newer gen) is cited around ~17.5 J/TH versus older WhatsMiner models around ~38 J/TH. That difference matters: a more efficient machine can be profitable at much higher electricity prices. Always plug the exact model numbers and current hashprice into a mining calculator before buying.

How to evaluate ROI (short checklist)

Hashrate (TH/s) and power (W) — divide watts by hashrate to get J/TH.

Electricity $/kWh — your single biggest ongoing cost.

BTC price & network difficulty — these move and affect payback time.

Downtime / maintenance — factor potential repair costs and time offline for used units.

Resale value / depreciation — new miners depreciate heavily in year one; used units have already taken most of that hit.

Safety and verification: don’t skip these steps

Buying used opens the door to scams and hidden damage. Use this verification checklist before you hand over money:

Ask for serial numbers and cross-check them with the manufacturer where possible.

Request performance proof — live hashrate videos, screenshots with timestamps, or preferably test runs in the seller’s presence.

Use escrow or verified marketplaces; never send full payment via direct crypto to an unknown seller.

Inspect physical condition: signs of overheating, burnt connectors, fan noise, or corrosion are red flags.

Prefer small-scale sellers or verified resellers over farm clearances if you want longer life expectancy.

When a used miner can outperform a new one

Used miners can beat new ones on ROI in the short term when:

You pay significantly less up front (large price gap).

Your electricity cost is very low.

You have the skills or local repair contacts to fix issues quickly.

You don’t need the latest generation efficiency to be competitive.

If any of those conditions aren’t true, the recurring higher power draw and repair risk often make new units the safer economic choice.

Practical buying tips

Run the numbers with a mining calculator (hashrate, power, electricity, pool fees).

Budget for spare parts — fans and PSUs are common failure points.

Check firmware — some older machines need updated firmware to be stable or secure.

Consider hosting — if you don’t want hardware hassle, colocating or using a hosting provider can simplify ops but will add ongoing costs.

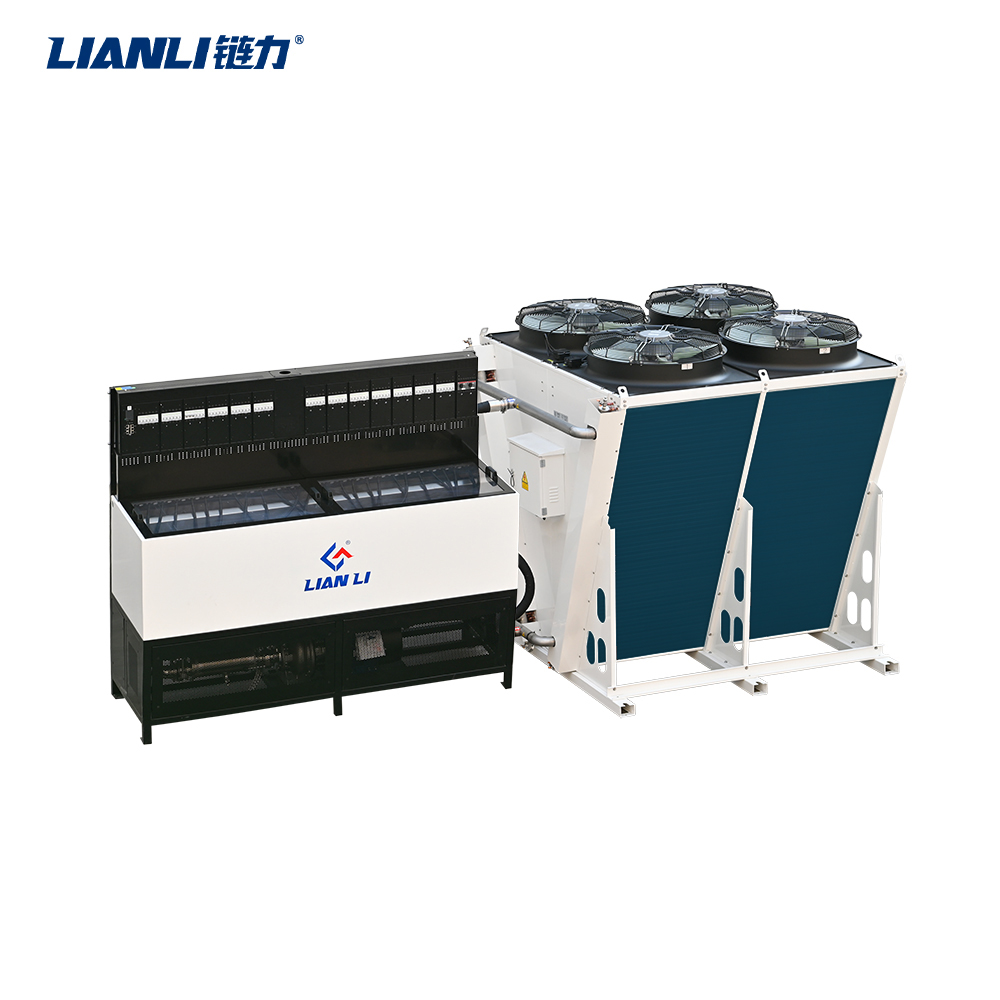

Suggestion:

Choose LIANLI’s ASIC liquid-cooling systems — their purpose-built hydro/immersion solutions (CDUs, hydro racks and high-capacity radiators) improve thermal stability, cut noise, and let miners run cooler and more reliably than standard air-cooled setups.

FAQ

Q: Should a beginner buy used to “learn”?

A: A lightly used unit from a verified seller can be a reasonable learning tool — but only if you accept higher failure risk and do the verification steps.

Is warranty always worth the premium?

A: For large purchases or for operators who can’t handle repairs, warranty coverage and manufacturer support often justify the extra cost.

What’s the single best rule of thumb?

A: If your electricity cost is high, prefer new efficient machines. If electricity is very cheap and you can manage repairs, used can be profitable faster.