A six-year review of market data shows that December has often delivered gains for major cryptocurrencies—but only under the right conditions. While the so-called “Santa Claus rally” is a recurring narrative in crypto markets, history confirms it is selective, not guaranteed.

This analysis reviews December price performance from 2019 to 2024 for five leading cryptocurrencies measured in USD: Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), Litecoin (LTC), and Monero (XMR). The data reveals a clear pattern: strong December rallies cluster around bullish cycles and recovery phases, not every holiday season.

Bitcoin: December Strength Appears Only in Bullish Phases

Bitcoin’s December performance has been highly cycle-dependent.

December 2020: BTC surged roughly 48%, climbing from about $19,700 to $29,000 during a powerful bull market.

December 2023: Bitcoin added around 12%, supported by ETF optimism and improving market sentiment.

However, December was far from reliable in other years:

2019: −5%

2021: −19%

2022: −4%

2024: −3%

Notably, Bitcoin’s strongest holiday moves tended to occur after Christmas rather than before, particularly in 2020 and 2023. Overall, Bitcoin’s December rallies align with expansionary liquidity and bullish momentum, not late-cycle tightening.

Ethereum: Tracks Bitcoin’s Cycle Closely

Ethereum largely mirrored Bitcoin’s December behavior.

December 2020: ETH gained about 21%, rising from roughly $615 to $750.

December 2023: ETH advanced around 11%, following broader market recovery and improved macro conditions.

In contrast, Ethereum struggled during bearish or late-cycle years:

2019: −15%

2021: −20%

2022: −8%

2024: −8%

Ethereum tends to perform well in December when risk appetite is strong and liquidity is abundant, but quickly turns negative during restrictive macro environments.

BNB: High-Beta December Performer

BNB (formerly Binance Coin) recorded some of the largest December swings in the dataset.

December 2020: +19%, driven by surging Binance trading volumes.

December 2023: +37%, rising from about $228 to $312 amid improved legal clarity and a rebound in spot trading activity.

However, downside risk has also been significant:

2019: −13%

2021: −18%

2022: −18%

BNB consistently behaves as a high-beta asset—outperforming Bitcoin in bullish Decembers but underperforming sharply during periods of regulatory or exchange-related stress.

Litecoin: A Leveraged Bet on Holiday Sentiment

Litecoin has historically amplified broader December market trends.

December 2020: LTC rallied approximately 42%, from $88 to $125, boosted by Bitcoin’s breakout and increased payment adoption narratives.

December 2023: +5%

December 2024: Estimated +7%

Bear-market Decembers were far less favorable:

2019: −13%

2021: −30%

2022: −12%

While Litecoin no longer delivers explosive rallies every cycle, it continues to benefit from late-year risk-on phases, particularly around halving-related narratives.

Monero: The Most Consistent December Performer

Monero stands apart for its defensive resilience during the holiday season.

December 2020: +15%

December 2022: +9% (while many assets declined)

December 2023: +10%, rising toward the $180 level

Even in weaker years, Monero’s December losses were relatively mild compared to other major altcoins. Its steady performance likely reflects ongoing transactional demand and its role as a privacy-focused asset during periods of regulatory uncertainty.

From 2019 to 2024, Monero avoided extreme December drawdowns, making it one of the most consistent late-year performers among mid-cap cryptocurrencies.

Santa Claus Rallies Are Conditional, Not Automatic

Historical data confirms that December strength in crypto is real—but highly selective. The strongest performances clustered in 2020 and 2023, both periods marked by bullish momentum or recovery.

Key takeaways for traders and investors:

December rallies favor bull markets and rebound phases

Bear markets reward defensive assets, such as Monero

Macro conditions and project-specific news matter more than the calendar itself

In short, the holiday season can be profitable—but only when the broader market backdrop supports risk-taking. December alone is not enough to guarantee a green finish to the year.

For more cryptocurrency market insights and seasonal trend analysis, follow the latest research from Lian Li.

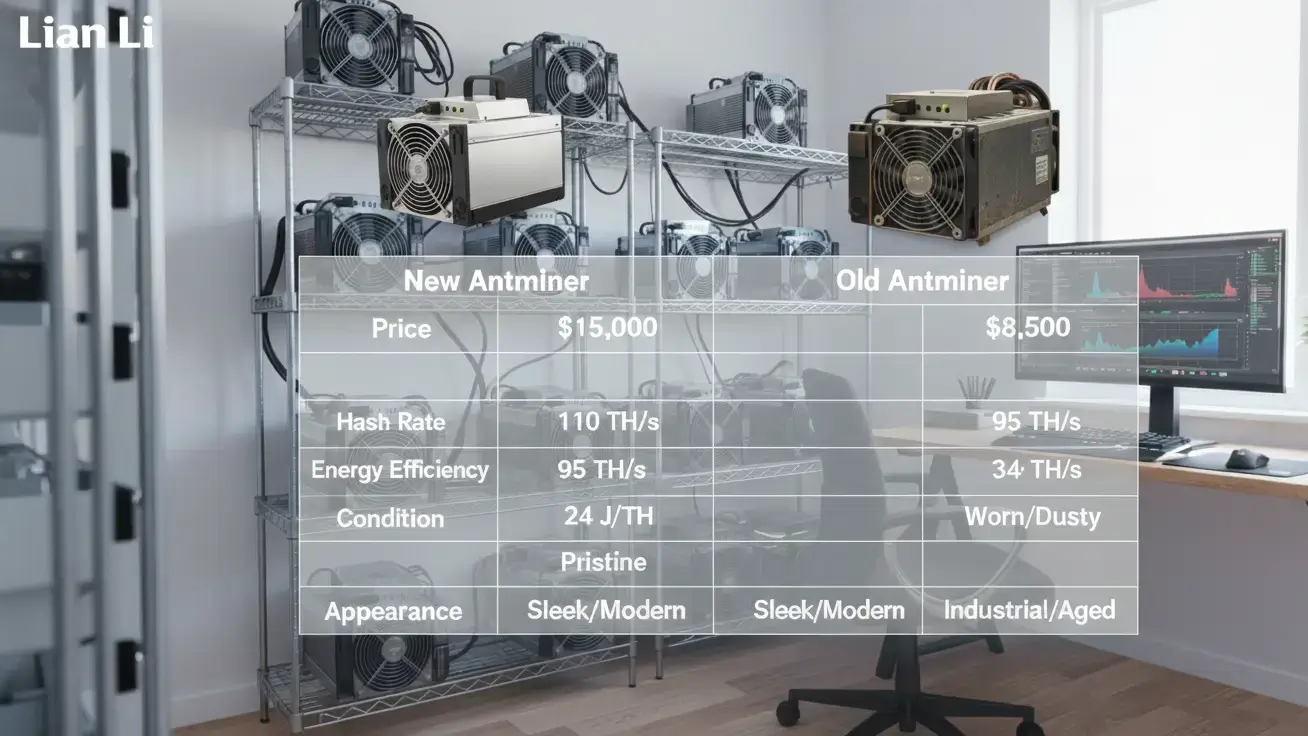

Pro Tip: Cooling Matters as Much as Hashrate in Crypto Mining

High hashrate alone does not guarantee efficient cryptocurrency mining. Advanced cooling solutions are critical to maintaining performance and controlling costs—especially as high-powered ASIC miners like Antminer and Whatsminer operate under extreme thermal stress.

Insufficient cooling can lead to lower efficiency, frequent throttling, accelerated hardware wear, and higher energy expenses.

Lian Li offers professional-grade liquid cooling and immersion cooling systems purpose-built for mining operations. These solutions deliver stable temperatures, improved energy efficiency, reduced noise levels, and extended hardware lifespan—making them ideal for both large-scale mining farms and serious individual miners.