Bitcoin (BTC), the world’s first and most recognized cryptocurrency, has been a topic of discussion ever since it hit the market in 2009. From humble beginnings to becoming a digital asset worth thousands of dollars, Bitcoin’s journey has been nothing short of remarkable. As we venture into 2025, the question on everyone’s mind remains: How much is one Bitcoin? In this article, we’ll dive deep into the current bitcoin price, what influences it, and where BTC could be headed in the future.

What is Bitcoin?

Before we explore the price of Bitcoin, let’s quickly understand what it is. Bitcoin is a decentralized digital currency, meaning it operates without a central bank or single administrator. Instead, it relies on blockchain technology—a distributed ledger that records transactions across a network of computers. This makes it secure and transparent, yet independent from traditional financial institutions.

Bitcoin was created by an anonymous person or group of people known as Satoshi Nakamoto, who released the Bitcoin whitepaper in 2008. Since then, Bitcoin has grown into a global phenomenon, and it is now seen as a store of value, a hedge against inflation, and a speculative investment for many. But the question persists: What is the current price of Bitcoin?

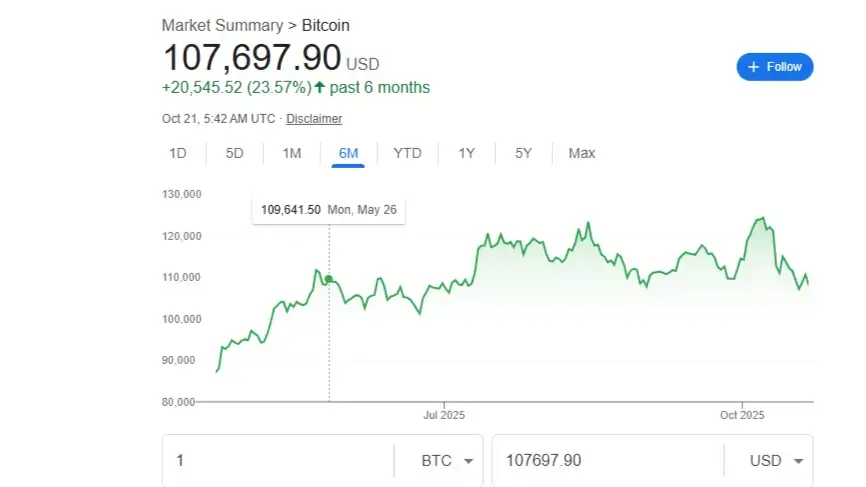

The Current Bitcoin Price: As of October 2025

As of October 2025, the bitcoin price fluctuates based on a number of factors. While the value of BTC can vary widely day-to-day, Bitcoin has seen impressive growth over the last few years. Currently, the BTC price is hovering around $10,000 per BTC, although this can shift rapidly depending on market conditions.

Why Does Bitcoin’s Price Change?

The price of Bitcoin, like any other asset, is determined by supply and demand. However, there are several unique factors that make Bitcoin’s price more volatile than traditional assets like gold or stocks.

Supply and Demand: Bitcoin has a fixed supply of 21 million coins. This limited supply, combined with increasing demand from both retail and institutional investors, tends to push the price upwards over time.

Market Sentiment: Bitcoin’s price is heavily influenced by news, regulations, and broader economic trends. Positive developments, such as major companies adopting Bitcoin as a payment method or large institutional investments, often drive the price up. Conversely, negative news, such as government crackdowns or security breaches, can cause a sharp decline in BTC’s price.

Mining and Halving: Bitcoin is created through a process called mining, where miners use computational power to validate transactions on the blockchain. Every four years, the reward for mining new Bitcoin is halved (known as the Bitcoin Halving), reducing the rate at which new Bitcoin enters circulation. This deflationary mechanic tends to increase scarcity, often leading to a rise in the BTC price post-halving.

Global Economic Factors: Economic conditions, such as inflation rates, monetary policy, and even geopolitical events, can also influence the Bitcoin price. Bitcoin is often viewed as a hedge against inflation, especially in times when central banks are printing more money.

What Affects Bitcoin’s Price in 2025?

Bitcoin’s price in 2025 is influenced by a few specific trends that could shape its value for the next few years.

Regulation: In the past, the lack of regulation in the cryptocurrency space has led to volatility. However, many countries are starting to introduce clearer regulations for Bitcoin and other cryptocurrencies. These regulations will likely stabilize the market, although the details remain to be seen.

Institutional Adoption: More companies are accepting Bitcoin as a legitimate form of payment. The involvement of big players such as Tesla, Square, and PayPal has contributed to Bitcoin’s acceptance as a mainstream asset. Additionally, institutional investors are increasingly viewing BTC as a long-term investment.

Technological Advancements: The Bitcoin network is constantly evolving. Improvements in scalability, security, and transaction speeds through upgrades like The Lightning Network could increase the network’s usability, making it more appealing to both everyday users and institutional investors.

Global Uncertainty: In times of global economic uncertainty, Bitcoin has historically performed well as investors look for alternatives to traditional assets. Geopolitical tensions, banking crises, and inflationary concerns can drive more people toward Bitcoin, boosting its price.

Bitcoin price on October 21st

How High Can Bitcoin Price Go?

While it’s impossible to predict Bitcoin’s price with certainty, many experts believe that BTC could reach new all-time highs in the coming years. Various forecasts predict that Bitcoin could potentially hit $200,000 or more in the future. Factors such as increased adoption, limited supply, and growing interest from institutional investors all point to a strong future for Bitcoin.

However, it’s important to note that Bitcoin’s price is still subject to significant fluctuations. Bitcoin has historically seen sharp rises and dramatic drops in value. Investors should proceed with caution and always be aware of the risks associated with cryptocurrency investments.

The Future of Bitcoin: BTC’s Role in the Financial System

As we look ahead, the future of Bitcoin remains uncertain but promising. Here are some potential outcomes for BTC in the next few years:

Global Currency: Some see Bitcoin evolving into a widely accepted global currency. While this may seem far off, it’s not out of the realm of possibility. With continued adoption by businesses and governments, Bitcoin could eventually replace traditional fiat currencies in certain regions.

Store of Value: Many investors view Bitcoin as a digital store of value akin to gold. Given its limited supply and increasing demand, Bitcoin could continue to appreciate in value over time, especially as fiat currencies experience inflation.

Increased Regulation: Bitcoin may face more regulation in the future, with governments establishing clearer guidelines for its use. While this could lead to more stability, it could also limit some of the aspects that make Bitcoin appealing, such as its decentralized nature.

Competition from Other Cryptocurrencies: While Bitcoin remains the king of cryptocurrencies, there is growing competition from other digital currencies like Ethereum, Solana, and others. These cryptocurrencies offer unique features that could outpace Bitcoin’s capabilities in the future, potentially impacting BTC’s dominance in the market.

Conclusion: Should You Invest in Bitcoin?

So, how much is one Bitcoin? In 2025, the bitcoin price hovers around $10,000, but it’s subject to rapid change. As with any investment, Bitcoin comes with a degree of risk, but it also offers unique opportunities for growth and financial gain. If you’re looking to diversify your investment portfolio or hedge against inflation, Bitcoin could be an appealing option.

However, it’s essential to do your research, understand the risks involved, and only invest money that you can afford to lose. Whether you’re a seasoned investor or a beginner, Bitcoin’s volatility can be both exciting and daunting. Always stay informed about the market, and remember that the BTC price could change at any moment.

For anyone looking to invest in Bitcoin, understanding the factors that drive the btc price and keeping an eye on the latest market trends is key. Bitcoin may very well be the future of finance, but it remains a speculative investment that requires caution, knowledge, and strategy.

Reminder: Bitcoin mining requires an efficient cooling system to maintain optimal performance. For high-performance mining rigs, consider using Lian Li immersion cooling systems for the best results.

FAQ About BTC

1. When was Bitcoin invented?

Bitcoin was invented in 2008 by an anonymous person or group known as Satoshi Nakamoto. It was officially released as open-source software in January 2009, marking the beginning of the Bitcoin network. The invention of Bitcoin revolutionized the way digital transactions are conducted, making it the first decentralized cryptocurrency.

2. Who owns the most Bitcoin?

The largest holder of Bitcoin is believed to be Satoshi Nakamoto, the pseudonymous creator of Bitcoin. It is estimated that Nakamoto owns around 1 million BTC, though these coins have never been spent. In addition, Bitcoin whales, including large institutional investors and crypto exchanges, also hold significant amounts of BTC, which impacts the overall market.

3. Is Bitcoin safe?

Bitcoin is generally considered safe due to its underlying blockchain technology, which is highly secure and resistant to fraud. However, Bitcoin users must take necessary precautions, such as using secure wallets and enabling two-factor authentication. While the network itself is secure, risks such as hacking, scams, and losing access to private keys still exist.